Investing in the share market is an exciting opportunity to grow your wealth and achieve your financial goals. Whether you’re a beginner or have some experience, this comprehensive guide will walk you through the essential steps to invest in the share market successfully. So, let’s get started!

How to Invest /Trade in the -Share Market in India?

If you’re wondering how to invest in the Indian stock market online, we’ve got you covered.

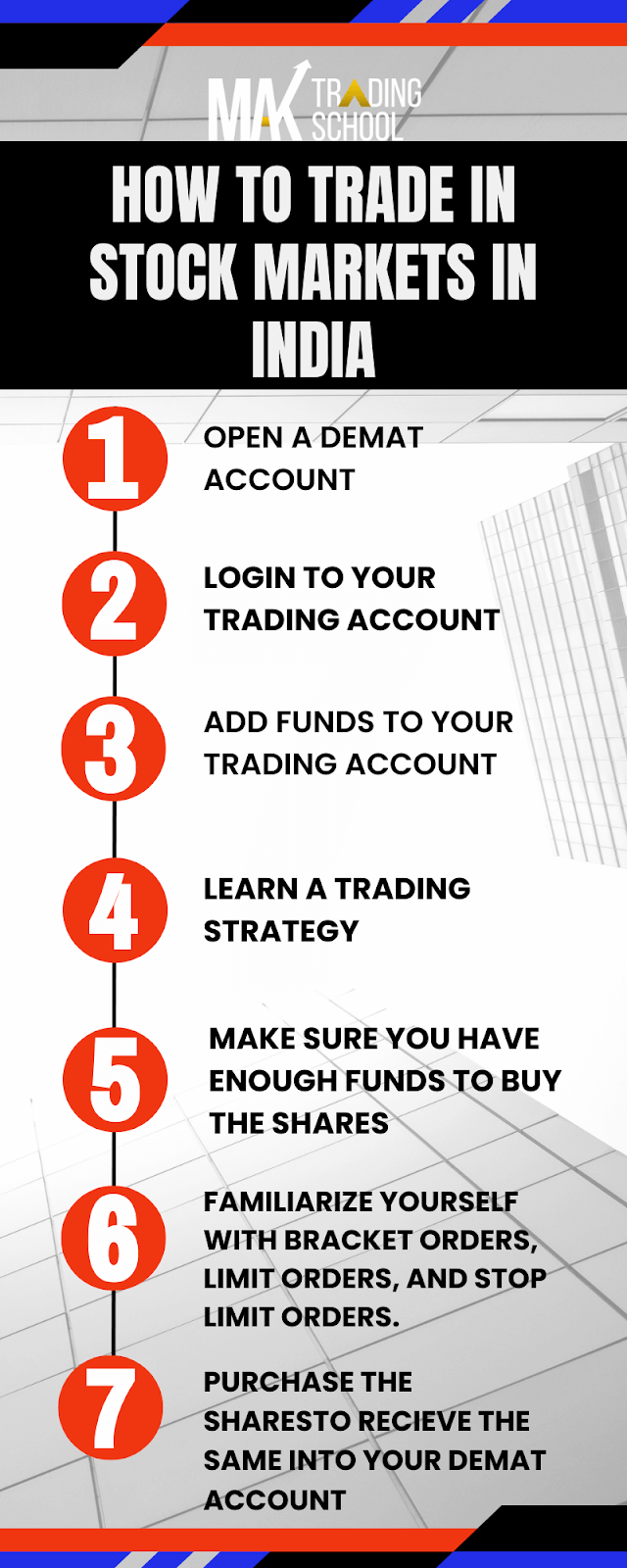

Here are the steps you need to do to buy stocks from the convenience of your own home:

Step 1 – Open a DEMAT & Trading account through any leading share broker and link it to your existing bank account to carry out transactions smoothly.

Step 2 – Log in to your Trading account via a Web based platform or App

Step 3– Add funds to your Trading account from your Bank account

Step 4 – Before you begin trading, develop a trading strategy that teaches you how to enter and exit trades.

Step 5 – Make sure you have enough money in your bank account to acquire the shares you want.

Step 6 – Buy the Stock at its Listed price. You can trade in the Cash segment, Futures and Options, Commodities, and forex markets.

Familiarize yourself with different order types. For e.g. Bracket Orders, Limit orders, Stop limit orders etc.

Step 7-Your purchase order will be executed whenever a seller responds to your request. Following the conclusion of the transaction, the required amount will be debited from your trading account. You will receive the shares in your DEMAT account

Also Read : Basics of Stock Markets

How to Open a Demat Account to invest in the share market in India?

Pre-requisites for Opening a DEMAT Account in India

- Bank Account

- Proof of Address

- Proof of Identity

- A reputed Stock Broker

Top Stock Brokers that allow you to register a DEMAT account with a single click

What is a Demat Account?

In the world of finance, a Demat account plays a pivotal role in facilitating the smooth and secure trading of securities such as stocks and bonds. Whether you’re a seasoned investor or just stepping into the world of financial markets, understanding what a Demat account is and how it works is essential.

Introduction to Demat Accounts

A Demat account, short for “Dematerialized account,” is a digital repository for holding and trading financial securities in electronic form. Gone are the days of physical share certificates; a Demat account has replaced them with a digital ledger where your investments are recorded electronically. A Demat Account is necessary in order to invest in the share markets in India.

The Purpose of a Demat Account

The primary purpose of a Demat account is to provide a secure and convenient way for investors to buy, sell, and hold securities. It eliminates the need for physical paperwork, making transactions more efficient and reducing the risk of loss or damage to share certificates.

How Does a Demat Account Work?

A Demat account works much like a bank account, but instead of holding cash, it holds your investments in the form of shares, bonds, mutual fund units, and other financial instruments. When you buy or sell securities, the transactions are recorded electronically in your Demat account.

Benefits of Having a Demat Account

Owning a Demat account comes with several advantages, including:

1.Safety and Security: Your investments are held electronically, eliminating the risk of theft or forgery associated with physical share certificates.

2.Convenience: Buying and selling securities can be done online, providing ease of access and flexibility.

3.Paperless Transactions: No more dealing with cumbersome paperwork; all your transactions are digital.

4.Instant Settlement: Settlement of trades occurs faster, typically within two working days.

5.Portfolio Tracking: You can easily monitor your investments and track their performance.

Also Read: What is Supply and Demand Trading Strategy

Demat Account vs. Trading Account: Understanding the Difference

In the world of stock market investing, two essential components play distinct but interconnected roles: the Demat account and the Trading account. These two accounts are often mentioned together, but they serve different purposes in the process of buying and selling securities. Let’s dive into the key differences and functions of a Demat account vs. a Trading account.

A Demat account and a Trading account are both essential for anyone looking to invest in the stock market. The Demat account provides a secure place to hold your investments, while the Trading account allows you to actively participate in the market by executing buy and sell orders. Understanding the distinctions between these two accounts is crucial for a successful and informed investment journey in the Indian Share Market.

Conclusion

Investing in the Stock market in India can be a promising avenue for wealth generation, but it requires careful consideration, research, and a long-term perspective. As an investor, it is crucial to understand the market dynamics, assess individual risk tolerance, and diversify the investment portfolio. While there are potential risks associated with stock market investments, with the right knowledge and a disciplined approach, investors/traders can capitalize on the opportunities presented by the dynamic Indian market to achieve their financial goal