How to Trade the Shooting Star Candlestick pattern?

To make well-informed decisions in the realm of financial markets, traders and analysts employ a variety of tools and strategies.

Candlestick patterns are one such technique that provides insightful information about the mood of the market and possible price moves.

Because of its implications for possible trend reversals, the shooting star candlestick pattern is particularly important among these patterns.

This article explores the nuances of the shooting star pattern, including information on its genesis, meaning, definition, and trading applications.

What is a Shooting Star Candlestick Pattern?

Candlestick patterns are visual representations of price changes over a specified time period.

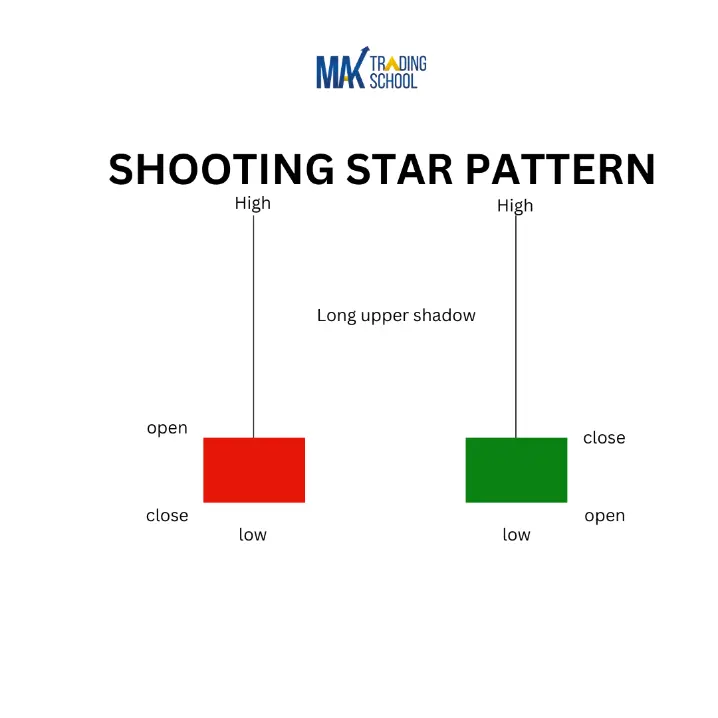

The shooting star pattern is distinguished by a single candlestick with a small body and a long upper shadow, which usually appears towards the end of an upswing.

The development of a shooting star indicates a possible reversal of the current trend, indicating a shift in market sentiment from bullish to pessimistic.

The Shooting star pattern is a very important candlestick pattern since it helps to identify future market reversals. Traders use this pattern to assess the strength of the current trend and to analyse a shift in trend.

The Green and Red candles are considered as Shooting stars ,but a bearish Red Shooting star is considered more potent or powerful.

In both cases , an appearance of the Shooting star at the top of an uptrend only generates a signal of an impending reversal and it should not be blindly traded a blind signal

Psychology Behind Shooting Star

Shooting star patterns represent underlying market psychology and investor attitude. The lengthy upper shadow shows buyer’s’ failed attempt to maintain upward momentum,

indicating a shift in sentiment from optimistic optimism to bearish scepticism. Understanding the psychological processes at work might help traders predict market reversals and make sound judgements based on market mood.

1.Bulls vs. Bears:

The shooting star pattern represents the ongoing conflict between the buyers and sellers.

2.Initial Bullish Momentum:

At the start of the trading session, buyers push prices upward which indicates bullish momentum.

3.Seller Intrusion:

Despite the early push by buyers, sellers enter the market, leading prices to fall by the end of the session.

4.Rejection of Higher Prices:

The long upper shadow of the shooting star candlestick signifies the rejection of higher prices by the market

5.Change in Attitude:

The market’s rejection of higher prices points to a change in sentiment among participants from bullishness to caution or bearishness.

6.Loss of Buyer Control:

The fact that market participants are rejecting higher prices suggests that they are becoming less in charge, which could cause market sentiment to change.

In the below example of LICHSGFIN, Daily Chart, we identified a Shooting star candlestick pattern. Notice the fall after the bearish candlestick pattern

Types of shooting star candlestick

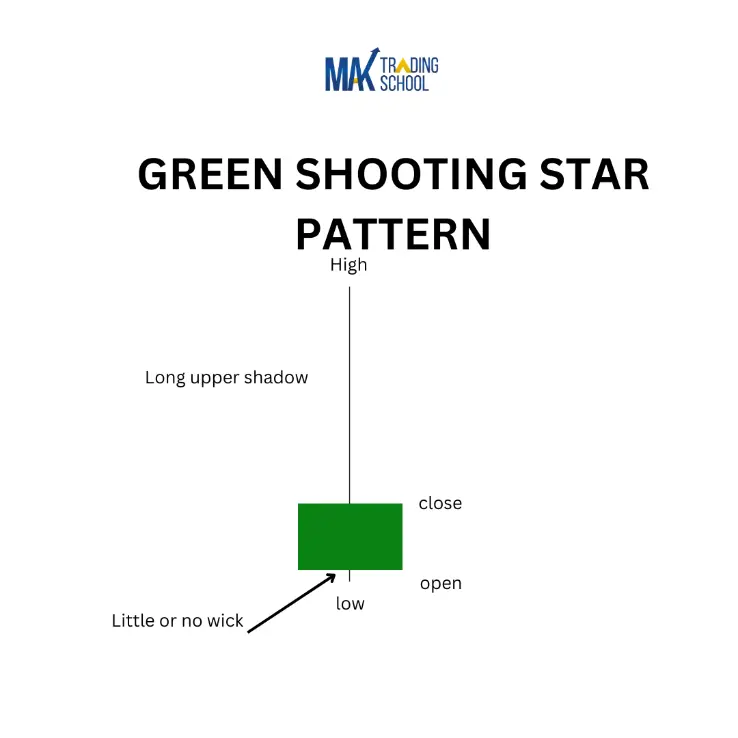

1.Green Shooting Star candlestick

A very less common but still a significant candlestick pattern that appears in an uptrend, indicates that despite the closing price being higher than the opening, sellers were able to push the prices down.

This pattern Indicates that the Bullish momentum is waning and bears are starting to push the prices down.

This type of candlestick pattern is not a strong reversal candle as the red shooting star candlestick, the bullish (green) Candlestick pattern indicates the traders to reassess their positions and strategy

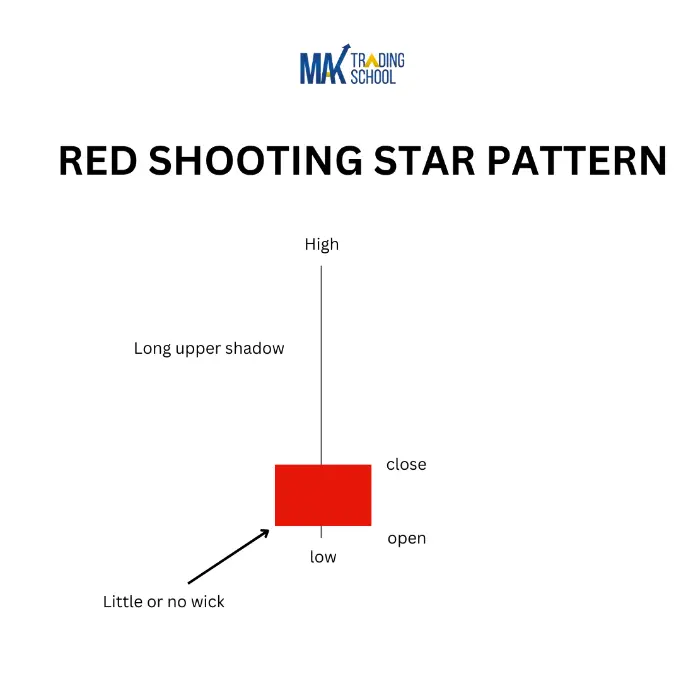

2.Red Shooting Star Candlestick

A Red Shooting Star Candlestick that appears in an uptrend is a potential reversal pattern.

The Red colour indicates a lower close that the open. It signifies that sellers gained the upper hand during the session.

This shift is crucial as it reinforces the pattern’s bearishness.

This type of candlestick pattern suggests buyers could not maintain control hence traders should be vigilant for a potential downtrend or prepare for the going short in the market.

The Shooting Star Pattern is a very significant Indicator of a trend reversal. Once you spot it in an uptrend, it indicates a potential reversal and that the bullish momentum is losing its steam.

Also Read: Best FREE Chartink Screener for Swing Trading (maktradingschool.com)

How should one trade a Shooting Star Pattern?

Trading the Shooting star candlestick pattern needs a strategic approach. Identifying this pattern after an uptrend, signals that the trend may be reversing. Traders can either secure Profits from their long positions or prepare for short selling.

But how can traders efficiently use this Candlestick Pattern?

One can identify these reversals in Support and Resistance areas. Identifying a Red Candlestick pattern in a major resistance area will be more potent than trading it in a support area.

Traders should always look for additional confirmation before trading in the market with the Shooting star Candlestick Pattern.

How to trade the Shooting Star Candlestick pattern with Supply and Demand Zones?

Supply and Demand Zones are Institutional Footprints in the financial markets. Its an Area where price has reversed due to an imbalance of buyers and sellers.

These imbalances are caused due to Institutions buying and selling leaving essential footprints on a chart.

A Supply Zone is a area where sellers pushed prices sharply down and while a Demand Zone indicates where buyers drove Prices up.

The Shooting Star candlestick can be traded in confluence with a Supply Zone for a more potent reversal. Let us see with an example

In the Above Image , we traded the Shooting star pattern with the confluence of the Supply and Demand Zone Trading Strategy

A confirmation entry , taken on a Supply zone will give you more confidence for the trade to work in your favour.

Take a look at this Video to learn more how to time your entries with Supply and Demand Trading Strategy

Learn more about the Supply and Demand Trading Strategy at www.maktradingschool.com or call us on 7400088842

Follow us on Youtube @maktradingschool , Facebook @maktradingschool, Instagram @maktradingschool

Linkedin @MAKTradingschool

Get Trained by MAK Trading School

Key Takeaways

The Shooting star pattern is a significant Bearish Candlestick Pattern in the world of Candlestick Patterns, particularly when identified after an uptrend. This pattern can be effectively traded with the help of other confirmation signals.

There are many ways one can trade this signal effectively. Its essential for beginners to understand the basic candlestick patterns and the psychology behind it .

Do not trade the markets with half-baked knowledge , approach the market with a solid understanding of a Strategy with proper trade planning, risk management , Entry and Exit rules .

You can check out this Webinar and learn how the top professionals trade in the market.

Frequently asked Questions

The shooting star pattern emerges at the top of an uptrend, whereas the hammer pattern shows at the bottom of a decline. A shooting star has a small body and a long upper shadow, whereas a hammer has a small body but a large lower shadow

A shooting star is a bearish candlestick pattern with a long upper shadow or wick and a short actual body at the low of the day.

The Opposite of a Shooting star candle is a Hammer Candlestick

Mahesh Kaamath

Mahesh Kaamath is a Price Action Trader, Founder and Mentor at MAK Trading School.Ex Instructor at OTA (Online Trading Academy). He is a Skilled Stock Market Trader and mentor for the past 11+ years and successfully trained more than 5000+ students.

He has a qualified degree in Hospitality management, from IHM Mumbai. Also, a Bachelor of Commerce degree from R A Podar College, Matunga. In his initial years he has worked with Oberoi Hotels and successfully ran his own Hospitality venture KAMKO group.