Stock Market Basics- A Beginners Guide

Are you also fascinated by the Stock Markets? Do you get overwhelmed by the jargons used in Trading? Do you want to earn a passive income from the Stock Markets?

Every year, thousands of people enter the Stock Markets to achieve financial freedom and earn consistent profits.

But 90% of Traders who enter the markets fail miserably. Do you know why?

Due to a lack of Knowledge and necessary skills.

So if you are a Beginner and want to enter or have already entered the Stock Market then this Blog is for you.

Let’s first understand

What is a Stock Market?

A Stock market serves as a marketplace where individuals and institutions can trade ownership shares of public companies.

This platform enables companies to obtain capital by selling stocks to investors who can later trade these stocks with the goal of profiting from price changes or receiving dividends based on the company’s performance. The stock market plays a crucial role in the economy by providing businesses with access to funds, enabling investors to allocate their investments, and indicating the state of the overall economic health

What is a Stock Market Exchange?

A stock market exchange is a central marketplace where individuals can buy and sell various types of securities, such as stocks and bonds. These exchanges provide a regulated and transparent environment for trading, with prices being determined by the forces of supply and demand.

One of the primary reasons that stock market exchanges are important is that they facilitate the flow of capital between investors and companies. Companies can raise funds by offering shares to the public, while investors can buy or sell these shares as they see fit. This process helps to create liquidity in the market, ensuring that capital is allocated efficiently.

Well-known examples of stock market exchanges include the National Stock Exchange, Bombay Stock Exchange, New York Stock Exchange, NASDAQ, London Stock Exchange, Tokyo Stock Exchange, and Hong Kong Stock Exchange. Each exchange operates independently and has its own unique characteristics.

What is a Stock Market Index?

A stock market index is a measure of the performance of a group of stocks that are representative of a particular market or sector. Stock market indexes are designed to track the performance of a specific market or segment of the market and are often used as benchmarks for measuring the performance of individual stocks or mutual funds.

Stock market indexes are usually calculated by taking the weighted average of the prices of the underlying stocks. The weight of each stock in the index is typically based on its market capitalization, but other factors such as revenue or book value may also be used.

There are many different stock market indexes that track various markets and sectors. For example,

here are several stock market indices in India that measure the performance of the Indian stock market. Some of the most commonly followed indices include:

NSE Nifty: The NSE Nifty is the benchmark index of the National Stock Exchange (NSE) and consists of 50 large-cap stocks from various sectors.

NSE Bank Nifty: The NSE Bank Nifty is the banking Index, it consists of the most liquid and large-cap banking stocks listed on the NSE.

BSE Sensex: The BSE Sensex is the benchmark index of the Bombay Stock Exchange (BSE) and is composed of 30 of the largest and most actively traded stocks on the exchange.

BSE Small Cap Index: The BSE Small Cap Index consists of 972 small-cap stocks from the BSE and is considered a measure of the performance of small and mid-cap companies in India.

BSE Mid Cap Index: The BSE Mid Cap Index consists of 125 mid-cap stocks from the BSE and is considered a measure of the performance of mid-cap companies in India.

These indices are used by investors, fund managers, and analysts to track the performance of the Indian stock market and make investment decisions. They are also used as benchmarks for measuring the performance of individual stocks or mutual funds.

What are the Two Major Indices in the Stock Market?

There are two major indices in the Indian stock market:

BSE Sensex: The BSE Sensex, also known as the Bombay Stock Exchange Sensitive Index, is the oldest and most widely followed stock market index in India. It consists of 30 of the largest and most actively traded stocks on the Bombay Stock Exchange (BSE). The Sensex is calculated using a free-float market capitalization-weighted methodology and is considered a benchmark for the Indian stock market as a whole.

NSE Nifty: The NSE Nifty, also known as the National Stock Exchange Fifty, is the benchmark index of the National Stock Exchange (NSE). It consists of 50 large-cap stocks from various sectors and is considered a more diversified index than the Sensex. The Nifty is calculated using a float-adjusted market capitalization-weighted methodology and is widely used by investors and fund managers to track the performance of the Indian stock market.

Common Jargons Used in the Stock Market

What is a Long Position?

A long position in the Stock Market is when an investor or trader purchases an asset, such as a stock, bond, or commodity, with the expectation that the asset’s value will increase over time. This purchase is a bet that the asset’s price will rise.

When an investor takes a long position, they intend to hold onto the asset for an extended period of time. They might sell the asset at a later date when they believe its value has increased, earning a profit based on the difference between the original purchase price and the sale price.

This strategy, known as taking a long position, is a common approach to investing. It is used by investors of all types, including individual investors, institutional investors, and traders.

What is a Short Position?

Short selling in the Stock Market is a tactic where investors or traders sell off an asset, such as a stock or commodity, anticipating its value to decrease over time. This means that the investor is wagering on the asset’s price to fall.

When an investor shorts a position, they’re essentially borrowing the asset and selling it on the open market. Later, the investor buys back the asset and returns it to the lender. If the asset’s price has decreased, the investor can buy it back at a cheaper price, return it to the lender, and earn a profit from the difference between the original sale and purchase price.

Short selling is a common method used by investors and traders to profit from a decline in an asset’s value. However, short selling is generally viewed as a more perilous strategy than holding a long position since the potential losses can be limitless if the asset’s price increases instead of decreasing.

Types Of Traders in the Stock Market

There are several types of traders in the stock market, each with its own unique characteristics and trading strategies. Here are some of the most common types:

Day Traders: Day traders buy and sell securities within the same day, taking advantage of short-term price movements in the market. They typically close out all of their positions by the end of the trading day and rarely hold positions overnight.

Swing Traders: Swing traders hold positions for a few days to a few weeks, aiming to profit from medium-term price movements in the market. They use technical analysis and market trends to identify potential entry and exit points for their trades.

Positional Traders: Positional traders hold positions for several months to several years, with the goal of profiting from long-term trends in the market. They rely on fundamental analysis and macroeconomic trends to identify potential investments.

Scalpers: Scalpers are day traders who aim to profit from small price movements by making many trades throughout the day. They often use high-frequency trading algorithms to quickly enter and exit positions.

Algorithmic Traders: Algorithmic traders use computer programs to automatically execute trades based on pre-set criteria, such as technical indicators or news events. They can make trades faster and more efficiently than human traders.

High-Frequency Traders: High-frequency traders use advanced algorithms and powerful computers to make trades at lightning-fast speeds, often holding positions for just a few seconds. They aim to profit from small price discrepancies between different markets or exchanges.

Each type of trader has its own strengths and weaknesses, and it’s important for investors to understand the different trading styles in order to make informed investment decisions.

How to Start Trading In India?

If you’re looking to start trading in India, here are some steps you can follow:

1.Open a trading account: You’ll need to open a trading account with a brokerage firm that is registered with the Securities and Exchange Board of India (SEBI).

- Choose a trading platform: You can choose between a traditional broker-assisted trading platform or an online trading platform. Online trading platforms are more popular nowadays as they offer convenience, lower brokerage charges, and real-time access to the stock market.

Zerodha, Sharekhan, Fyers, Upstox are some examples

Fund your trading account: Once you have opened a trading account, you’ll need to fund it with sufficient funds to start trading. You can do this through online banking, debit or credit card, or a check deposit.

- Learn about trading: Before you start trading, it’s important to understand the basics of trading, such as how to read stock charts, understand financial statements, and develop a trading strategy. There are many online resources available to help you learn about trading.

Join the Trading Mantra Workshop, to learn about the Foundation of Supply and Demand Trading Strategy.

- Start trading: Once you feel comfortable with your knowledge and understanding of trading, you can start buying and selling stocks on the stock market.. Monitor your trades: It’s important to monitor your trades regularly and make adjustments to your trading strategy as needed.

Also Read: A Simple Price Action Trading Strategy using Supply and Demand Levels

Remember that trading involves risk, and it’s important to invest only what you can afford to lose.

Trading with a Strategy

A significant number of novice traders commence their trading journey without a well-formulated strategy and expert guidance, often relying on news channels and recommendations from acquaintances.

The outcome is commonly unfavorable, with losses incurred in the stock markets leading to a sense of despair and abandonment. It is noteworthy that 90% of individuals entering this field with the intention of earning a passive income lack a solid strategy, and those who do succeed are reticent to share their methods.

To realize gains in the stock markets, it is essential to approach trading as a business, with necessary expenses and profits following in due course.

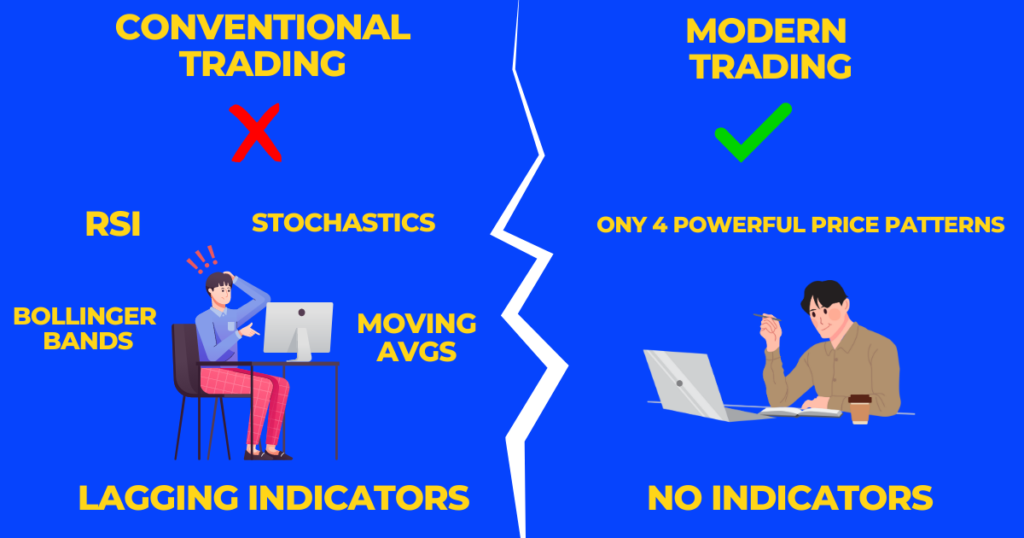

Conventional Trading Vs Modern Trading

In Conventional trading, people use technical indicators like RSI, Stochastics, and Bollinger bands. These indicators are based on past price movements and are not very effective at predicting future trends.

On the other hand, modern trading focuses on price action, which means trading without any indicators or oscillators. By analyzing patterns and movements in the price itself, traders can make more accurate predictions.

One popular type of price action trading is supply and demand trading, which is becoming increasingly popular in the stock market. This approach involves identifying supply and demand zones created by large institutions and banks, and trading based on those zones. It is a pure form of price action trading that relies solely on analyzing the movements of the price itself.

Also Read: GAP Trading Strategies that no one told you about

Conclusion

In conclusion, understanding the basics of the stock market can be a valuable tool for anyone looking to invest their money wisely. By knowing how the stock market works, investors can make informed decisions about when to buy and sell securities, and how to manage their portfolio risk. While there is no surefire way to guarantee success in the stock market, having a solid understanding of the fundamentals is essential for making sound investment decisions over the long term. With this knowledge, investors can confidently navigate the sometimes volatile waters of the stock market and achieve their financial goals.

The Core Strategy Course offered by MAK Trading School provides a comprehensive curriculum that covers fundamental and advanced concepts of the stock market. This course is ideal for individuals who are new to the stock market and includes weekly live Q&A sessions.

By enrolling in the course or signing up for the workshop, you will gain a solid foundation in Supply and Demand Trading Strategies. Don’t miss out on this opportunity to expand your knowledge and skills in the exciting world of the stock market. Enroll for the Workshop

Website: www.maktradingschool.com

Email: Support@maktradingschool.com

Call us:7400088842